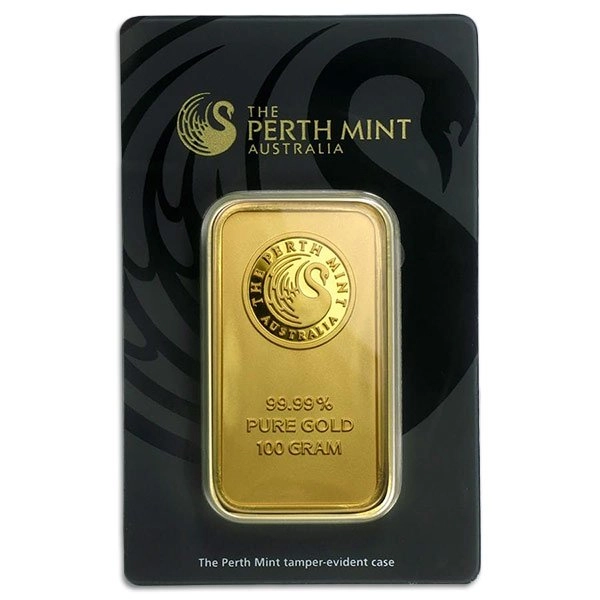

Buy 100 Gram Perth Mint Gold Bar (New w/ Assay)

$6,550.00

Buy 100 Gram Perth Mint Gold Bar (New w/ Assay)

| Mint Mark | P – Perth Mint |

| Purity | 0.9999 |

| Manufacturer | Perth Mint |

| Thickness | 1.5 mm |

| Condition | New |

| Edge Design | Smooth |

| Series | Perth Mint Gold Bar |

| CoA | No |

| Packaging Type | In Assay |

| Metal Weight | 3.215 Troy Ounces |

| Shipping | Free Shipping on Orders Over $199

Tracking and insurance included on all orders |

| Dimensions | 28.24×98.18 mm |

Description

Buy 100 Gram Perth Mint Gold Bar (New w/ Assay)

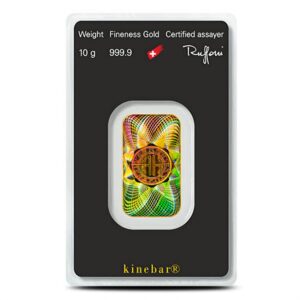

Each 100 Gram Perth Mint Gold Bar has been produced by the renowned Perth Mint, one of the most illustrious mints in the world. The Perth Mint has been making high–quality products for more than a century. Complex Bullion is delighted to offer these gold bars, which we ship in their original mint-sealed packaging.

Bar Highlights:

- Contains 100 grams (3.215 oz) of .9999 pure gold.

- Produced by the Perth Mint.

- Each bar comes with an assay card that offers a unique bar number.

Each 100 Gram Perth Mint Gold Bar has been produced with 100 grams of .9999 pure gold. This superior level of refining is uncommon in the gold bullion industry and is further evidence of the mint’s continued excellence. Each bar is stamped with the Perth’s logo, which features its telltale swan. Each bar is also inscribed with its weight and gold purity. The opposite side of every bar features a repeating pattern of hopping kangaroos, a symbol of Australia’s wildlife heritage.

Complex Bullion will ship each 100 Gram Perth Mint Gold Bar in brand new condition. We will package it with safety and security in mind and mail it out in discreet packaging. In addition, we also completely insure each shipment against lost or damage. These government backed gold bars will complement any collection of gold bullion.

The Advantages of Buying 100 Gram Gold Bars

Investors buy gold as a hedge against the depreciating US dollar and uncertainty. The 2008 financial crisis was a wake-up call for people who have done all of their saving and investing in conventional securities. They discovered, despite what their brokers and financial advisors told them, that true diversification can’t be achieved by holding a basket of stocks, bonds, and mutual funds. At the end of the day, those are all paper assets.

Their value is 100% dependent upon the continued operation of the fragile interconnected global financial system. We have learned this system is complex, highly leveraged, and riddled with fraud. It is also completely dependent on perpetual supplies of stimulus in the form of debt at ultra-low interest rates. It is only a matter of time before another crisis collapses the confidence in Wall Street and all of the paper they have been pushing on Americans.

True diversification means holding some assets outside of the financial system. Investors need something that carries intrinsic value and does not have counter-party risk. Ideally, this will be an asset with the potential for the price to increase as confidence in the paper falls. That is why investors choose physical gold.

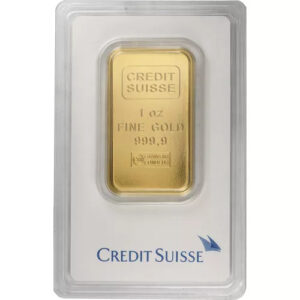

Investors choose gold bars because they generally offer lower pricing than government-issue coins. Bars also come specially packaged and protected in an assay holder with certification from the manufacturer regarding weight and purity.

The 100 Gram Gold Bar

Gold is concentrated wealth. A single bar, which can fit easily into your pocket, is the equivalent of several thousand dollars. It is private and portable. It requires very little space to store and can be easily hidden away.

Perhaps the best feature of these bars is their excellent performance as an investment over long periods of time. Your stock broker won’t tell you, but gold has dramatically outperformed stocks over the past 20 years. And it is poised to do even better in the next two decades. The federal government is insolvent. Congress and the Fed have lost all discipline and have blown the largest debt bubble in the history of the world. The reckoning for this massive irresponsibility cannot be avoided forever.

Too much trust has been placed in Wall Street and the financial system. Despite the lessons of 2008, banks are even more leveraged than before. The exposure to the same complex derivatives involved in that melt-down has grown, not shrunk.

There is no substitute for buying gold at the lowest possible price per ounce from a reputable manufacturer. 100-gram bars are a fantastic choice.

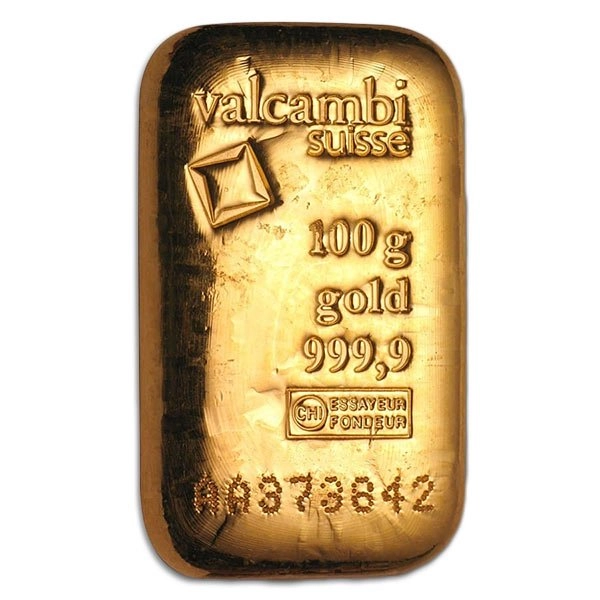

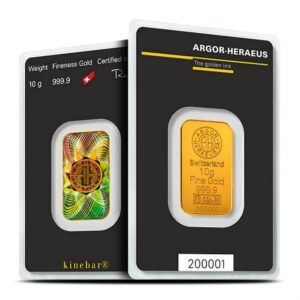

Popular 100 gram Gold Bars

The Austrian Mint and the Perth Mint offer two of the most popular 100 gram gold bars. Both offer well-made and attractive bars and both have an excellent reputation with investors and dealers alike.

Comparing Premiums

The production cost is perhaps the largest factor when determining the premium buyers pay above the spot market price for raw metal when it comes to gold bars and coins. Government Mints tend to have higher costs and to charge higher premiums. Private mints and refiners, such as PAMP Suisse, Perth Mint, Valcambi Suisse, tend to be more competitive.

The size of the bar is also a factor. In general it requires less labor and machine time to produce a single larger bar than to produce multiple smaller bars. That is why the price per ounce for a single 100-gram bar is much lower than for 100 one-gram bars.

The quantity of bars involved in the transaction will also have some bearing on price. As you may expect, the more you buy the lower your price will be.

Money Metals Exchange publishes all of our pricing live, making it easy to compare premiums. Investors can compare premiums versus those for other gold products as well as versus other dealers offering the same 100-gram bar.

Gold bars are a bullion product (non-collectible) sold in high volume. Investors can expect premiums to be very low – just a few percent above the market value for gold.

100 gram Gold Bars for Short-Term Investments

Investors tend to buy gold for the long haul. However, 100-gram bars are among the best suited of bullion products for an someone making a relatively short-term trade. The bid/ask spread – the difference between what it costs to buy versus what is received when selling – is lower than for many other products. Investors can couple that low spread with low-cost storage at Money Metals Depository to avoid the delays and expense associated with shipping. There is no better way to trade physical metal – especially short term.

100 gram Gold Bars for Long-Term Investments

Gold bars purchased a low premium, from a brand-name manufacturer, are a great way to invest in and hold gold. And gold itself is an asset with literally thousands of years of track record. It has been a vehicle for wealth preservation since ancient times.

The sooner, the better for investors acknowledge that preparing for the decades ahead means changing some strategies that worked over the past several decades. The people of the world have certainly seen governments spend themselves into insolvency and fiat currencies, such as the dollar, do not last forever. Despite that, practically nobody is prepared for that to happen in the USA. All of the signs are there, but, somehow most people are caught by surprise.

Gold is a hedge against too much debt, too much money printing and against the unexpected. It has filled that role perfectly for most of recorded history.

Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),Buy 100 Gram Perth Mint Gold Bar (New w/ Assay),

Reviews

There are no reviews yet.